What is a Credit Score?

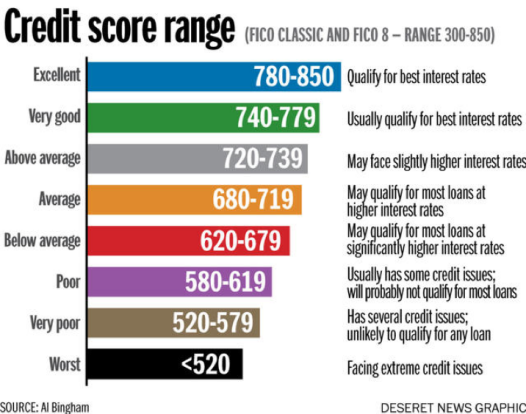

A credit score is a number that represents the risk a lender takes when you borrow money. Chelsea Fagan, cofounder of The Financial Diet, defines credit scores as “a numerical score – ranging from 300 to 850 that represents your creditworthiness, how trustworthy you are with your money.” Joseph Sangl, local financial educator and founder of “I Was Broke, Now I’m Not,” defines credit scores as “a measure or one’s ability to manage debt.” The most widely used credit score is a FICO score, which is a well-known measure created by the Fair Isaac Corporation, and used by credit agencies to indicate a borrower's risk. When a consumer applies for credit – whether for a credit card, an auto loan, or a mortgage – lenders want to know what risk they'd take by loaning money. “A FICO credit score only looks at debt” (Sangl, 2009).

How Does It Affect Me?

A credit score is a financial label that shows lenders if you qualify for a loan. It also serves as factor in determining what your interest rate will be on the loan you receive. A credit score can be the reason you can or cannot purchase a home, car, or get a business loan. In the financial industry, credit scores can help or prevent you from getting a job or receiving a certification. Needless to say, they are a very important aspect of life.

Components of a Credit Score

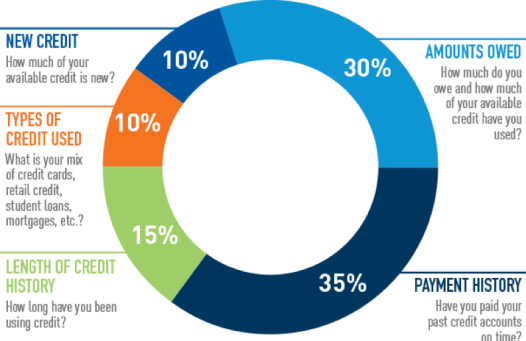

There are multiple components that contribute to the calculation of a credit score. For the FICO credit score the components include amount owed by individuals, payment history reports, length of credit history, the types of credit used by a person, and new credit available. Some components contribute at a greater percentage than others, but each piece is equally important and should be understood by those interested in building and a maintaining a healthy credit score.

30% Amounts Owed: Debt with outstanding balances and payments still being made.

35% Payment History: Also known as payment timeliness. Making payments regularly when they are due is a key ingredient to building and maintaining a healthy credit score. Missing a payment one or more times can have negative impacts on your credit score.

15% Length of Credit History: The number of years you have been using credit to make purchases.

10% Types of Credit Used: Revolving debt (such as credit cards) and installment debt (such as loans that require regular payments) are both contributors to credit score calculations.

10% New Credit: The amount of credit you have available to use. Having a large available credit limit (unused credit) shows lenders that you manage your debt well enough to have carry large balances. Other the other hand, it can also show creditors that you have a higher opportunity to quickly accumulate a substantial amount of debt.

How to Establish Credit

- Use secured credit cards. A secured credit card is just like a regular credit or (unsecured credit card), you are required to put down a security deposit to provide assurance to the creditor that you will repay your debt. Your credit limit is often the amount of your security deposit.

- Use gasoline credit cards. Since this is a regular monthly expense, it a necessary purchase. Having a credit card for a gas station store will allow you to make planned purchases that can easily be included in your budget and paid off on time each month.

- Place utilities in your name. This is an important element when you want to apply for a loan. Lenders want proof that you can make payments regularly, in full, and on time. Utilities bills show creditors that you can do just that. It is not unusual for a creditor to want 1 year or more in utility payment history in order to qualify for a loan.

“You can pay now and play later OR you can play now and pay later. Either way, you have to pay.”

– John Maxwell

How to Maintain a Good Credit Score

- Pay your bills and credit card statement balances on time.

- Keep your credit card balance(s) low or at zero.

- Pay your bills and statement balances in full.

- Do not let your bills go unpaid and sent to a collections agency.

- Only spend 1/3 of your credit limit. This keeps your credit card balance(s) low or at zero. This rule of thumb shows creditors that you are not going to hit your max limit and possibly not pay the balance off on time.

- Check your credit report regularly. Report any suspicious activity immediately.

- Only apply for credit when you need it. If you close a credit card account, your credit score will decrease. Likewise, if you have too many open accounts, lenders view it as potential debt and may not grant you a loan.

- Contact your lender if you fall behind on your payments. Some lenders provide extensions or accommodations if you request them. Also, keep in mind that you can request your credit card companies to adjust your credit limit. If you think the credit limit is larger than necessary, call and request them to decrease. As mentioned above, having too much available credit is a sign for potential debt. In addition, you can request that your interest rate be adjusted if you have a good credit score. Sometimes creditors will approve the request and just like that you have a lower interest rate for the future on that account!

“Your credit score should not define who you are, but it will play an important role in your future financial decisions.”

– Joseph Sangl

Find out your credit score FREE

You may access a FREE credit report in detail once a year through Annual Credit Report.com. A detailed credit report will show month by month payment status, every lender you’ve borrowed from, and their contact information. Get your free report that will include the major agencies, Equifax and TransUnion at www.annualcreditreport.com

Did you know that when you apply for credit your score is affected by a “hard inquiry” that can lower your score a few points each time? Want to monitor your credit a little closer? You can check your credit score, at any time, without affecting your score using Credit Karma. Using Credit Karma will also allow you to receive alerts when an account is opened in your name….and the best part is it’s FREE. You can access it online or download the app on any smart device. Try it at www.creditkarma.com

References

Benson, P. (2017). From Failure to Financial Fitness.

Sangl, J. (2009). What everyone should know about money before they enter the real world. NIN Publishing.